Preface

This post is a revision of an earlier post titled The 9-Forces Model – Industry Structural Analysis. In the earlier post, The 9-Forces Model was presented, but it clearly showed Ten forces. The tenth force, Environmental Ecology, was almost begrudgingly it would seem, added for the sake of political correctness. Well, political correctness wasn’t the goal, but perhaps taking people on a journey of acceptance was.

It is well past the time to accept that the willful, ignorant, and delusional neglect and abuse of the environment should stop. It has always been the case that we affect and are affected by the environment; often the effects are long-lasting, and often they are permanent. There is no Planet B, Earth is the only home we have. Earth is likely to remain our only home for many generations to come. We should take care of our nest, our home.

Introduction

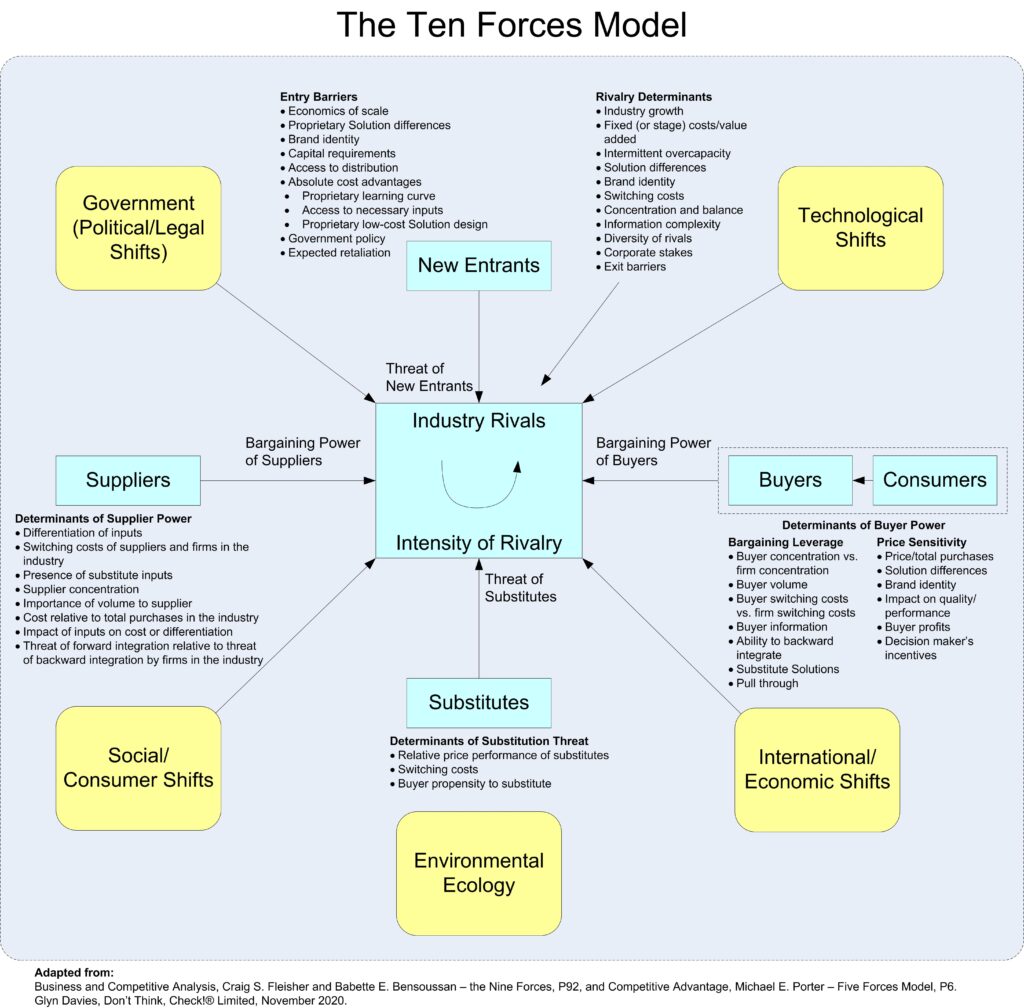

A business does not exist in a vacuum, its existence and activities affect its respective industry environment, and its industry environment influences and constrains what is possible for a business. It is prudent, therefore, to estimate the probability that your Business Model will make a profit before you create a new business or introduce a solution. This estimation can be performed with a technique called industry structural analysis, and a specific tool for this is the hybrid Ten-Forces Model introduced below.

Industry Structural Analysis

The Five Forces Model (Porter, 1985), is a useful tool to analyse an industry and whether it is or can be structurally attractive, meaning, “is there a reasonable balance of power between the five forces of rivals, potential entrants, buyers, suppliers, and substitutes[?]” (Cole, 1994). In other words, what is the likelihood that you will make a profit and that the business will grow? And, what is the likely position of the business in the industry?

Over time the Five Forces Model has been adapted, and below is presented The Ten-Forces Model for industry structural analysis.

The material below, unless stated otherwise, has been adapted from Business and Competitive Analysis, page 92 (Fleisher, 2007), and Competitive Advantage, page 6 (Porter, 1985).

For each component in the diagram above, there is a section below providing more information. In each section that follows, use what has been provided, not as an exhaustive or definitive list, but as prompts for thinking deeply about what is relevant and therefore what should be analysed in your context.

Competition

Competition should be thought of more widely than simply existing rivals. All organisations behind the Ten-Forces in your industry are competitors in the sense that they are all trying to extract maximum profit for themselves. (Porter, Competitive Strategy, 1990).

Michael Porter has another model, commonly called the Four Corners Model (Porter, 1980), and this can be useful for predicting a competitor’s course of action: The Tool is comprised of (adapted from Wikipedia, September 2019):

The Four Corners Model

Motivation (drivers)

The question to be answered here is: What is it that drives each competitor, what are their goals? And based on these drivers, as well as each competitor’s current competitive position, what are their responses likely to be regarding our activities? It is useful to try to determine competitors’ actions by understanding their goals (both strategic and tactical) and their current position with respect to their goals. A wide gap between the two could mean the competitor is highly likely to react to any external threat that comes in its way, whereas a narrower gap is likely to produce a defensive strategy.

Motivation (management assumptions)

The question to be answered here is: What are respective competitors’ assumptions about the industry, the competition, and its own capabilities? The perceptions and assumptions the competitor has about itself and its industry would shape strategy. This corner includes determining each competitor’s perception of its strengths and weaknesses, organisational culture and their beliefs about their competitors’ goals. If the competitor thinks highly of its competition and has a fair sense of industry forces, it is likely to be ready with plans to counter any threats to its position. On the other hand, a competitor who has a misplaced understanding of industry forces is not very likely to respond to a potential attack.

Actions (strategy)

The questions to be answered here are: What is each competitor actually doing and how successful are they in implementing their current strategy? A competitor’s strategy determines how it competes in the market. However, there could be a difference between the company’s intended strategy (as stated in the annual report as well as in interviews) and its realised strategy (as is evident in its acquisitions, new Solution development, etc.). It is therefore important here to determine each competitors’ realised strategy and how they are actually performing. If current their strategy is yielding satisfactory results, it is safe to assume that the competitor is likely to continue to operate in the same way.

Actions (capabilities)

The questions to be answered here are: What are the strengths and weaknesses of each competitor? In which areas is each competitor strong in? This looks at a competitor’s inherent ability to initiate or respond to external forces. Though it might have the motivation and the drive to initiate a strategic action, its effectiveness is dependent on its capabilities. Its strengths will also determine how the competitor is likely to respond to an external threat. An organisation with an extensive distribution network is likely to initiate an attack through its channel, whereas a company with strong financials is likely to counter attack through price drops.

Rivals

The following is a non-exhaustive list of factors to consider seriously. How will each of the factors affect your venture? Are there other factors to consider?

Rivalry Determinants

- Industry growth.

- Fixed (or stage) costs/value added.

- Intermittent overcapacity.

- Solution differences.

- Brand identity.

- Switching costs.

- Concentration and balance.

- Information complexity.

- Diversity of competitors.

- Corporate stakes.

- Exit barriers.

Suppliers

The following is a non-exhaustive list of factors to consider seriously. How will each of the factors affect your venture? Are there other factors to consider?

Determinants of Supplier Power

- Differentiation of inputs.

- Switching costs of suppliers and firms in the industry.

- Presence of substitute inputs.

- Supplier concentration.

- Importance of volume to supplier.

- Cost relative to total purchases in the industry.

- Impact of inputs on cost or differentiation.

- Threat of forward integration relative to threat of backward integration by firms in the industry.

Substitutes

The following is a non-exhaustive list of factors to consider seriously. How will each of the factors affect your venture? Are there other factors to consider?

Determinants of Substitution Threat

- Relative price performance of substitutes.

- Switching costs.

- Buyer propensity to substitute.

Buyers and Consumers

The following is a non-exhaustive list of factors to consider seriously. How will each of the factors affect your venture? Are there other factors to consider?

Bargaining Leverage

- Buyer concentration vs. firm concentration.

- Buyer volume.

- Buyer switching costs vs. firm switching costs.

- Buyer information.

- Ability to backward integrate.

- Substitute Solutions.

- Pull through.

Price Sensitivity

- Price/total purchases.

- Solution differences.

- Brand identity.

- Impact on quality/performance.

- Buyer profits.

- Decision maker’s incentives.

New Entrants

The following is a non-exhaustive list of factors to consider seriously. How will each of the factors affect your venture? Are there other factors to consider?

Entry Barriers

- Economics of scale.

- Proprietary Solution differences.

- Brand identity.

- Capital requirements.

- Access to distribution.

- Absolute cost advantages.

- Proprietary learning curve.

- Access to necessary inputs.

- Proprietary low-cost Solution design.

- Government policy.

- Expected retaliation.

Government (Political/Legal shifts)

Are there any signs of local or national governmental changes or shifts in policy or laws? For example, are there any signs that current subsidies may change or be removed?

Technological Shifts

Are there any signs of technological improvements or changes that would affect your venture? For example, an accelerating uptake of mobile phones compared to fixed-line services.

International/Economic Shifts

Are there any signs of international or economic changes that would affect your venture? For example, are there signs of changes to international labour rules and will these increase labour costs?

Social/Consumer Shifts

Are there any signs of changes in social behaviours or consumer preferences that would affect your venture? For example, a shift from cars with internal combustion engines to electric cars.

Environmental Ecology

All the above nine forces obviously happen here on planet Earth, at least for the foreseeable future, and therefore occur within our local, national, and global environmental ecology.

Are there any signs of changes to the environment or management of the environment that would affect your venture? For example, more stringent water use and waste water disposal standards or CO2 emissions.

Bibliography

Cole, Gerald A. (1994). Strategic Management. New York. Continuum.

Fleisher, Craig S, and Bensoussan, Babette E. (2007). Business and Competitive Analysis. New Jersey. FT Press.

Porter, Michael E. (1980). Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York. FT Free Press.

Porter, Michael E. (1985). Competitive Advantage: Creating and Sustaining Superior Performance. New York. Free Press.